cfs tax software order form

E-filing and printing are both free. CFS Tax Software Inc.

Software Compatible Tax Forms 1099 W2 And More Discounttaxforms Com

Verify that you are current on all Windows Updates.

. Form to file consolidated financial statements and other documents with the Registrar e-Form AOC 4 NBFC. We recommend the following steps. In order to calculate the sales tax of an item we need to first multiply the pre-tax cost of the item by the sales tax percentage after it has been converted into a decimal.

Purchase Options 941940 First-Time Purchase. OnePriceTaxes Tax Software allows you to file your individual federal and state income Tax return with the IRS and your state all for the one low price of 1995. You have not previ.

We also offer free support for any Tax questions you may have about filing your income Tax return. The following companies have passed the IRS Assurance Testing System ATS requirements for Software Developers of electronic Employment Tax Returns for Tax Year 2021. With OnePriceTaxes Tax Software you can e-file.

Yes we offer state e-filing for the current tax year for an extra 149 per form for select states that have additional 1099 filing requirements beyond the Combined Federal State filing program. Meeting the requirements means that the software can provide correct data in the proper format for processing by IRS systems. E-Form AOC 4 CFS.

CFS Tax Software Inc. If you are having problems accessing eStatementseNotices it may be because of recent changes to your operating system software such as upgrades or downloads. Use this form to certify that you are a representative or employee of a State agency that the State of California will pay the occupancy tax and that the charges incurred were in the performance of official duties.

Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. Form 24Q 26Q 27Q. You must electronically apply for a TCC if.

This can affect your computers ability to connect with a secure site. Notice to declare the address of the location in which the books of accounts are maintained e-Form ADT 1. Is a leading developer of tax utility software for tax professionals.

The 1099-NEC will participate in CFS starting in tax year. The form contains a list of questions which need to be answered so that a company can gauge the buyers mentality and motive behind making a purchase. A buyer questionnaire form generally surfaces when a potential buyer is showing interest or has confirmed in buying a particular asset or property as a home vehicle services of some kind etc.

Mail Order Authorization Code Request Form Word Format HSBC Securemail User Guide. TDS Statements for Q2 of 2021-22. CA Form DE 678 - Tax and Wage Adjustment CA Form DE 9ADJ - Quarterly Contribution and Wage Adjustment Form.

Meeting the requirements means that the software can provide correct data in the proper format for processing by IRS systems. Quarterly return of non-deduction at source by banks from interest on time deposit for September quarter. 941940 plus Network Upgrade First-Time Purchase.

Form for NBFCs to file financial statement and other documents with the Registrar e-Form AOC 5. The following companies have passed the IRS Assurance Testing System ATS requirements for Software Developers of electronic Employment Tax Returns for Tax Year 2020. 941940 Renewal plus Network Upgrade.

Reimbursement for Accident and Emergency Service Fee Form English Chinese Tax Reporting for Cessation of Employment e-Form. Once the sales tax has been calculated it needs to be added to the pre-tax value in order to find the total cost of the item. Contract for Service Request Form CFS-A-12-2018 PDF Format Template of Contract for Service Agreement CFS-B-09-2018.

CFS Form Order Worksheet CO Form DR 1093 - Annual Transmittal of State W-2 Forms CO Form DR 1106 - Annual Transmittal of State 1099 Forms. Each year over 30000 tax and accounting firms across the United States trust CFS for affordable high-quality and reliable software. A Transmitter Control Code TCC is required to e-file 1099s and certain other information returns to the IRS.

Transient Occupancy Tax Form. Lets start by working with an example. Upload of particulars of declarations received in Form 60 from April-September.

See our State Info page for more details on state requirements and which states we support.

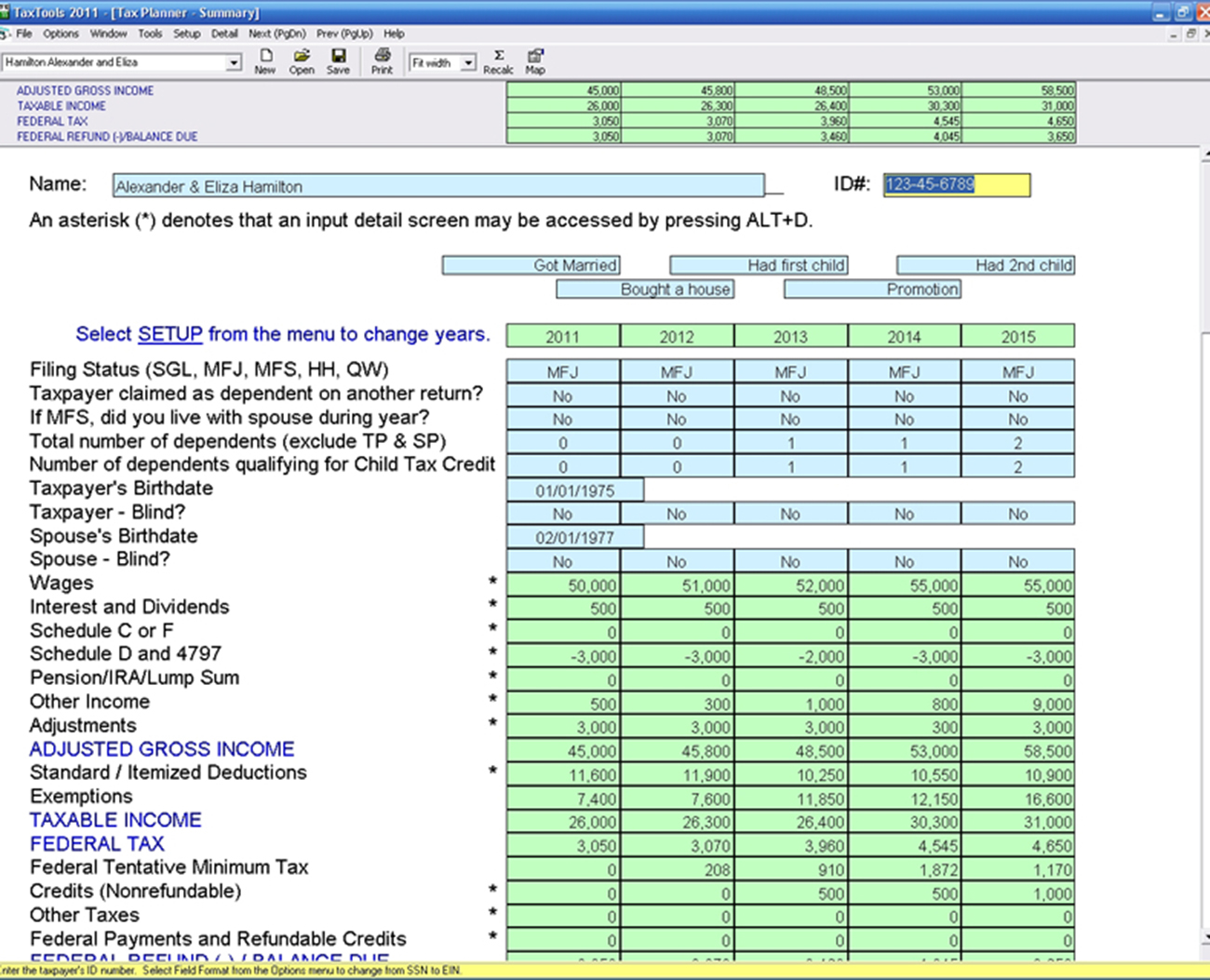

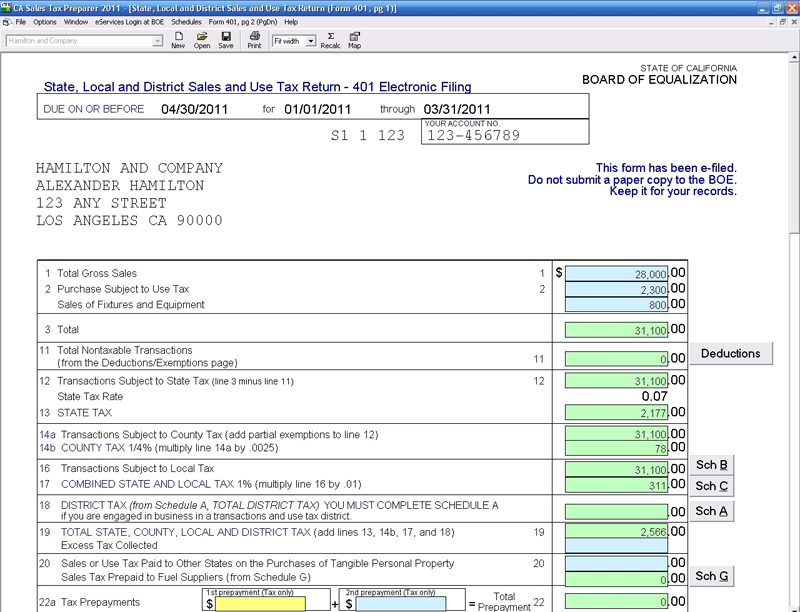

Taxtools Cfs Tax Software Inc Software For Tax Professionals

Cfs Tax Software Inc Cpa Practice Advisor

Cfs Tax Software Inc Cpa Practice Advisor

Live Payroll Cfs Tax Software Inc Software For Tax Professionals

Cfs Tax Software Inc Cpa Practice Advisor

Cfs Tax Software Inc Cpa Practice Advisor

Cfs Taxtools Review Pricing Pros Cons Features Comparecamp Com

Utility Software Pricing Alternatives More 2022 Capterra

Payroll System Overview Youtube

Tax Included In Purchase Invoice Total Microsoft Dynamics Nav Forum Community Forum

Vat Setup Microsoft Dynamics Ax Forum Community Forum

Taxtools Cfs Tax Software Inc Software For Tax Professionals

Tax Included In Purchase Invoice Total Microsoft Dynamics Nav Forum Community Forum

Taxtools Cfs Tax Software Inc Software For Tax Professionals

Price Comparison Cfs Tax Software Inc Software For Tax Professionals